Business

Foreign inflows into Nigerian stock market hit 15-year low

Quis autem vel eum iure reprehenderit qui in ea voluptate velit esse quam nihil molestiae consequatur, vel illum qui.

Foreign investors’ purchases of Nigerian stocks have declined for the sixth straight year, new official data show, as they remained on the sidelines despite reforms that sparked a massive rally in the market.

The total amount of stocks bought by foreign investors fell to N174.80 billion last year, the lowest since 2008, from N195.76 billion in 2022, according to data from the Nigerian Exchange Limited (NGX).

In 2008, foreign inflows plunged to N153.46 billion in the thick of the global financial crisis that led to a stock market crash in the country.

Stocks worth N235.82 billion were offloaded by foreign investors last year, up from total sales amounting to N183.47 billion in 2022.

With the higher foreign outflows seen in 2023, the market reversed 2022’s net inflows of N12.29 billion – which was the first since 2017.

The market suffered a net foreign outflows of N61.02 billion in 2023, even as it rallied for the first time in an election year since 2007, racing to a 15-year high. It finished the year with a return of 45.90 percent, more than double that of 2022 and the highest in three years, data compiled by BusinessDay show.

Several analysts and industry watchers attributed last year’s robust performance to the reforms implemented by the President Bola Tinubu, corporate earnings and new listings on the NGX.

“The policy stance of the government rejuvenated confidence in Nigeria’s financial market. Swift and decisive reforms, including removing fuel subsidies and harmonising the foreign exchange market rates, attracted domestic and foreign investors to the capital market,” the Nigerian Economic Summit Group (NESG) said in its macroeconomic outlook report for 2024, adding that the market was predominantly driven by domestic investors.

Foreign inflows into Nigerian stocks had jumped more than seven-fold in May last year to N27.51 billion, its highest level since December 2021, as the market soared on the last two trading days of that month following the announcement of petrol subsidy removal by Tinubu on May 29.

The increase in foreign participation was however shortlived as foreign exchange scarcity lingered in the country.

Africa’s biggest economy has been grappling with a dollar shortage since 2016 when it slipped into its first recession in over two decades induced by the oil price collapse that started in mid-2014 and the sharp decline in its production of the commodity.

Business

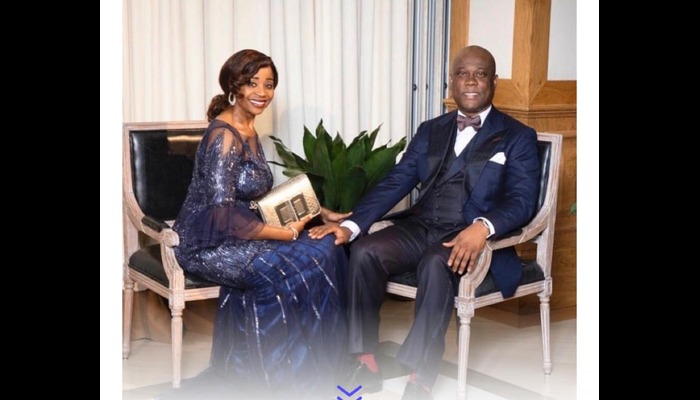

Who was Herbert Wigwe?

Herbert Onyewumbu Wigwe, a luminary in the Nigerian banking sector, was born on August 15, 1966 in Isiokpo, Port Harcourt, Rivers State. As the CEO of Access Holdings Plc, traded as Access Corporation, Herbert Wigwe carved a niche for himself in the world of finance.

From humble beginnings to a banking titan

Wigwe’s academic journey was as impressive as his professional ascent. With a degree in accountancy from the University of Nigeria and further education in Banking and Finance, Financial Economics, and an executive program from Harvard Business School, he was well-equipped for the challenges ahead.

His career began at Coopers & Lybrand, Lagos, before moving to GTBank, where he spent over a decade honing his skills in corporate and institutional banking. The turning point came in 2002 when he and Aig-Imoukhuede took a bold step by investing in Access Bank, then a small player in Nigeria’s banking industry.

Under Wigwe’s visionary leadership, Access Bank transformed into a powerhouse, now serving over 6.5 million account holders and ranking among the top 500 global banks. His roles extended beyond banking, as he served in various capacities, including as the Chairman of Access Bank Ghana Limited and a member of several prestigious boards.

A legacy of innovation and philanthropy

Wigwe’s impact was not limited to banking. His passion for philanthropy led him to establish the Herbert Wigwe Foundation, fostering education and entrepreneurship in Nigeria. His dedication earned him the Order of the Niger (CON) and admiration from peers and the public alike.

The dream of Wigwe university

Perhaps Wigwe’s most ambitious project was the establishment of Wigwe University. Launched with a $500 million investment, the university aimed to revolutionise higher education in Nigeria and West Africa. With a focus on management, science, engineering, and the arts, Wigwe University was set to provide world-class education, blending traditional methods with innovative technology.

The university, situated in Isiokpo, Port Harcourt, was approved by the National Universities Commission in June 2023. Its curriculum was designed to address critical sectors such as finance and technology, while also nurturing leadership and entrepreneurial skills.

Wigwe’s vision was clear: to create an institution that could compete globally, yet remain distinctly African. He planned to recruit top teaching talents from around the world, focusing on making education a tool for shaping fearless, innovative leaders.

An unparalleled educational experience

Wigwe University promised not just academic excellence but a holistic approach to education. Sports, arts, and practical experience were integral parts of its curriculum, ensuring that students received a well-rounded education. The university’s inaugural batch was expected to be a diverse group of 1,400 students, with plans to increase enrollment significantly over the next five years.

Business

Lagos begins N750m ‘Trader Money’ payment

The Lagos State Government, on Wednesday, flagged off the Lagos Market Trader Money Initiative to give N50,000 cash to each of 15, 000 traders in the state to boost their businesses.

Governor Babajide Sanwo-Olu, while unveiling the programme at LTV8, Agidingbi, Ikeja, said the beneficiaries were selected through a methodical process.

The governor said 200 of the beneficiaries were selected from markets in each of the 57 local government

areas and local council development areas.

He said 50 beneficiaries were selected by the Iyaloja/Babaloja General in each LGA/LCDA making a total of 14,250 traders.

“750 beneficiaries were identified from markets within the barracks and military formations across the state in collaboration with their respective Iyaloja/Babaloja. This brings the total number of beneficiaries to 15,000.

“To ensure fairness in the selection process while demonstrating the spirit of Lagos as being home to all, the beneficiaries were drawn from across all the geopolitical zones of the nation with 11,039 from the South-West, 914 from the South-East, 868 from the South-South, 1,710 from North-Central, 373 from the North-West and 107 from the North-East,” Sanwo-Olu said.

He added that 74 per cent of the beneficiaries were women while the remaining 26 per cent were men.

He said 33.7 per cent of them are below 40 years while 66.3 per cent are above 40 years.

The Commissioner for Agriculture, Abisola Olusanya, explained that: “This initiative is part of the government’s efforts towards ensuring sustainable livelihoods and wealth creation for traders across the state.”

Business

President Bola Tinubu ‘Silently’ Re-introduces Fuel Subsidy’

The administration of President Bola Tinubu has been accused of silently re-introducing the payment of fuel subsidies in Nigeria in order to keep the price of petrol stable.

The administration of President Bola Tinubu has been accused of silently re-introducing the payment of fuel subsidies in Nigeria in order to keep the price of petrol stable.

The allegation was made by the International Monetary Fund (IMF) in a statement over the weekend.

Recalls President Tinubu in his inauguration speech during his swearing-in on May 29, 2023, famously announced an end to the fuel subsidy regime.

The president has since maintained that the subsidy payment is an albatross on the nation’s economy, crippling the economy and enriching a few.

The decision marked an immediate spike in the price of petrol, which went up from about N187/litre to N300, N400, and has maintained a steady increase, with most filling stations in the country currently selling above N600/litre.

The increase in petrol price has led to a sharp increase in the price of other items and commodities, including foodstuff and transportation, with many Nigerians groaning under the weight of the price increases.

However, the IMF, in a statement issued at the conclusion of its Executive Board’s Post Financing Assessment with Nigeria, however, said the Tinubu government has re-introduced subsidy through the backdoor by capping the price of fuel at retail stations.

The IMF also urged the government to completely stop the payment of subsidies on petrol to free funds to run the government.

The IMF, in its latest statement at the weekend, said the Tinubu administration has “capped retail fuel and electricity prices” ostensibly to “ease the impact of rapidly rising inflation on living conditions, thus partially reversing the fuel subsidy removal.”

According to Daily Trust, an investigation in September revealed that the federal government paid N169.4 billion as subsidy in August to keep the pump price at N620 per litre.

The platform said a document from the Federal Account Allocation Committee (FAAC), sighted by one of its reporters, showed that in August 2023, the Nigerian Liquefied Natural Gas (NLNG) paid $275m as dividends to Nigeria via NNPC Limited. NNPC Limited used $220 million (N169.4 billion at N770/$) out of the $275 million to pay for the PMS subsidy. Then NNPC held back $55 million, illegally.

-

Entertainment2 weeks ago

Entertainment2 weeks agoLeaderboard

-

Entertainment2 weeks ago

Entertainment2 weeks agoActress Toyin Abraham To Release A New ‘Alakada’ Film In December 2024

-

Entertainment2 weeks ago

Entertainment2 weeks agoActress Shola Sobowale Debunks Fake News Of Being Arrested For Drug Trafficking in Saudi Arabia

-

Entertainment2 months ago

Entertainment2 months agoThe Big One Is Here

-

Entertainment2 weeks ago

Entertainment2 weeks agoLate Actress Rachael Oniga’s Daughter Cries At Her Wedding Over Song ‘Dedicated To Mothers’

-

Entertainment2 weeks ago

Entertainment2 weeks agoProminent Nigerian Music Star, Fireboy, Releases New Single ‘Everyday’

-

Entertainment2 weeks ago

Entertainment2 weeks agoActress Lola Alao: I Was Slapped By A Patient On My Care-Giving Job In Canada

-

Entertainment7 years ago

Entertainment7 years ago10 Artists who retired from music and made a comeback